Understanding Trading Fees and Commissions in India: A Beginner’s Guide

As a trader in India, you’re likely familiar with the concept of fees and commissions. But have you ever stopped to think about what you’re actually paying for? In this article, we’ll break down the different types of trading fees and commissions in India, and provide you with a comprehensive guide to understanding what you’re paying.

Why Do Trading Fees and Commissions Matter?

Trading fees and commissions can eat into your profits, reducing your overall returns. In fact, high fees can even turn a profitable trade into a losing one. By understanding what you’re paying, you can make more informed decisions about your trading strategy and choose the right broker for your needs.

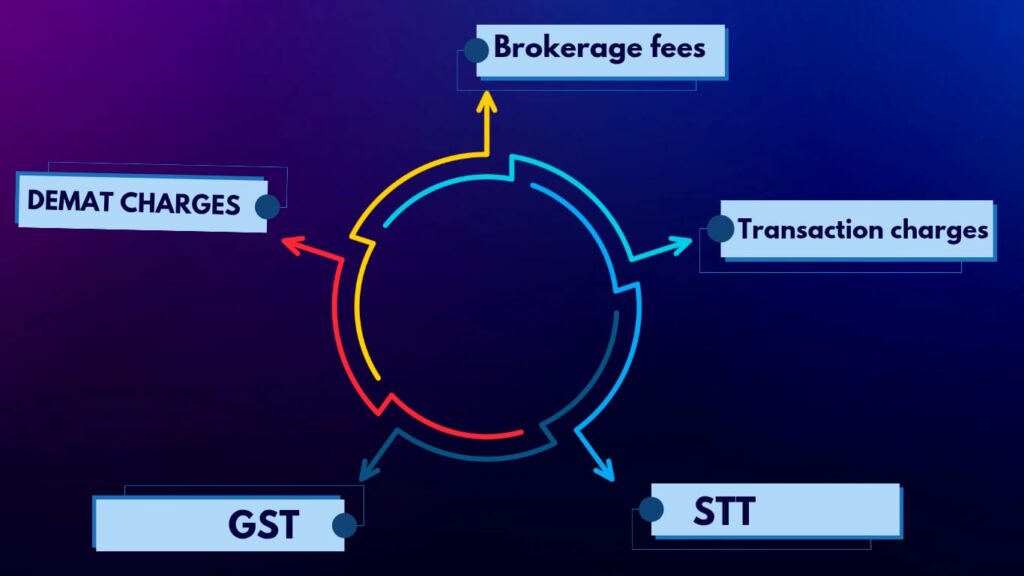

Types of Trading Fees and Commissions in India

There are several types of trading fees and commissions in India, including:

1. Brokerage Fees: These are fees charged by brokers for executing trades. Brokerage fees in India typically range from 0.01% to 0.1% per trade.

2. Transaction Charges: These are fees charged by the exchange for executing trades. Transaction charges in India typically range from ₹1.5 to ₹325 per crore.

3. STT (Securities Transaction Tax): This is a tax levied by the government on securities transactions. STT in India typically ranges from 0.01% to 0.1% per trade.

4. GST (Goods and Services Tax): This is a tax levied by the government on goods and services, including brokerage services. GST in India typically ranges from 18% to 28%.

5. Demat Charges: These are fees charged by depositories for maintaining demat accounts. Demat charges in India typically range from ₹20 to ₹100 per month.

How to Calculate Trading Fees and Commissions in India

Calculating trading fees and commissions in India can be complex, but it’s essential to understand how they’re calculated. Here’s a simple example:

Let’s say you buy 100 shares of XYZ stock at ₹500 per share, and the broker charges a brokerage fee of 0.05% per trade. The total brokerage fee would be:

100 shares x ₹500 per share = ₹50,000

Brokerage fee: 0.05% of ₹50,000 = ₹25

Tips for Reducing Trading Fees and Commissions in India

While trading fees and commissions are unavoidable, there are ways to reduce them. Here are some tips:

1. Choose a low-cost broker: Look for brokers that offer low or no brokerage fees.

2. Trade in bulk: Trading in bulk can reduce the overall brokerage fee per trade.

3. Use limit orders: Limit orders can help reduce brokerage fees by ensuring that your trades are executed at a specific price.

4. Avoid overnight positions: If possible, avoid holding positions overnight to reduce overnight charges.

5. Stay active: Regularly trading can help avoid inactivity fees.

Conclusion

Trading fees and commissions in India can be complex and confusing, but understanding what you’re paying is essential for making informed trading decisions. By choosing a low-cost broker, trading in bulk, and using limit orders, you can reduce your trading fees and commissions. Remember, every rupee counts, and minimizing your trading costs can help maximize your returns.

FAQs

Q: What is the average brokerage fee in India?

A: The average brokerage fee in India varies depending on the broker and the type of trade. However, on average, brokerage fees can range from 0.01% to 0.1% per trade.

Q: How do I know what trading fees I’m paying?

A: You can find information about trading fees on your broker’s website or by contacting their customer support.

Q: Can I negotiate trading fees with my broker?

A: In some cases, yes. If you’re a high-volume trader or have a large account balance, you may be able to negotiate lower trading fees with your broker.